Who is liable for losses resulting from check fraud? In 1986, for example, 72 percent of the FBI check fraud cases involved “insiders.” Today, if your business experiences check fraud, the criminal will most likely be someone outside your firm. Before electronic publishing systems became widely available, check fraud was more often than not a crime committed against a corporation or financial institution by someone inside the company. This new technology has not only changed the modus operandi for check fraud but has also led to a new profile for the criminal. Today, most corporate check fraud involves the use of electronic image-processing equipment to produce forged checks, duplicate checks, or checks with altered dollar amounts. Not long ago, the majority of corporate check fraud cases involved stolen check stock.

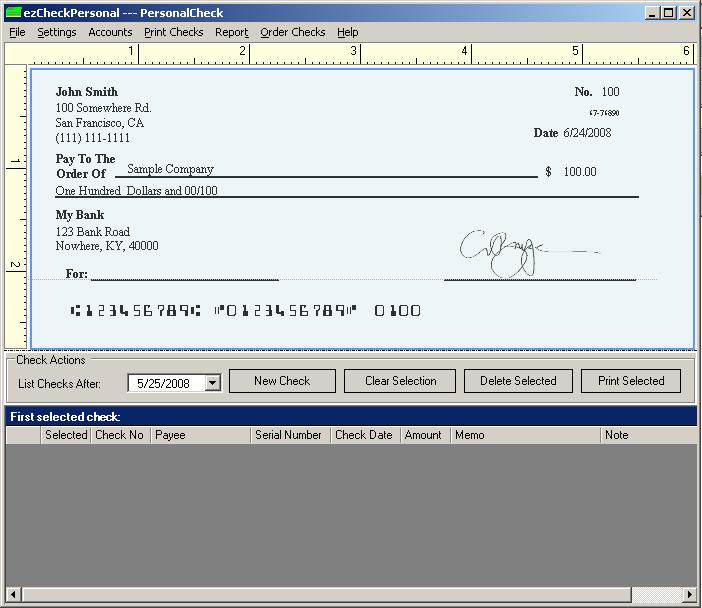

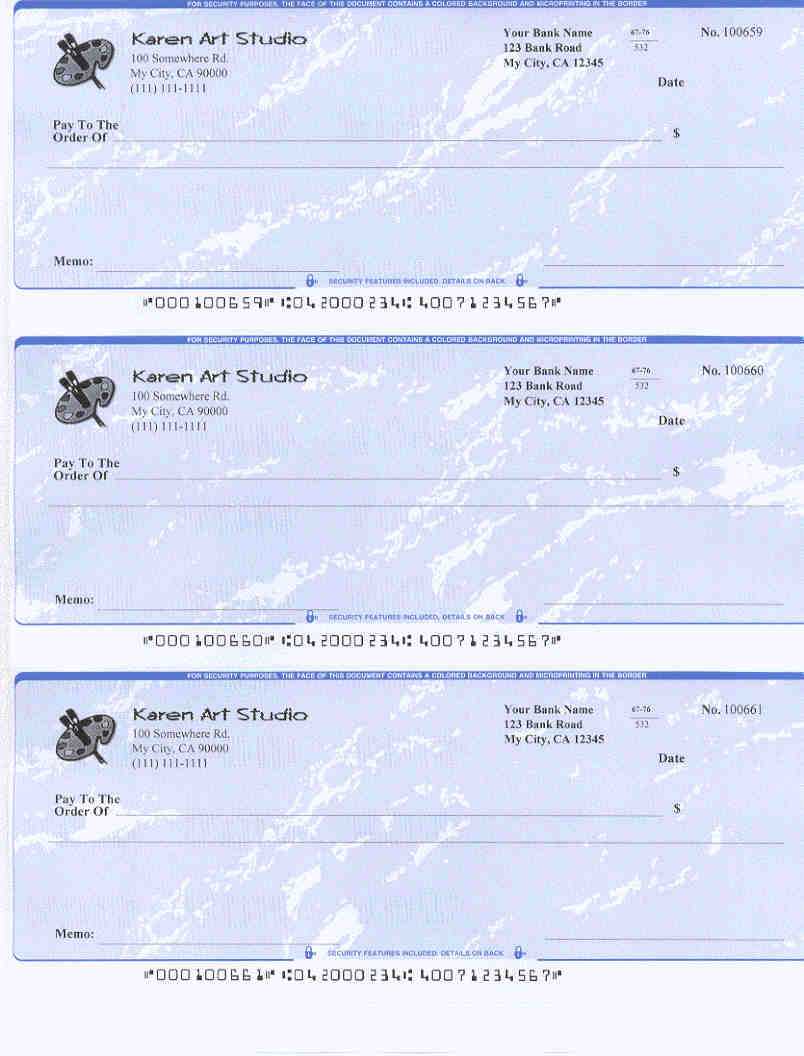

Using color copiers, laser printers, scanner and desktop publishing systems, counterfeiters can easily produce excellent copies of corporate checks. This situation makes it easier for criminals to successfully negotiate fraudulent checks.Ī second major reason for the recent increase in check fraud is the availability of low-cost, professional-quality electronic publishing and copying technology.

Because of Regulation CC and competitive pressures to accelerate availability, banks are increasingly making funds available for checks before those checks have actually cleared. Under Regulation CC, banks are required to make funds available within two days for local checks and within five days for out-of-town checks. Check fraud has increased substantially since 1988, when new regulations were introduced to accelerate check deposit availability. Why is corporate check fraud reaching epidemic proportions?Ĭheck fraud is a relatively low risk crime with potentially high stakes and good odds of success. A substantial portion of those fraudulent checks are for large dollar amounts. In 1993, The Wall Street Journal reported that the amount of counterfeit checks written against corporate accounts totaled at that time an estimated $1 billion annually.

In recent years, corporate check fraud has been increasing at an alarming rate.

Check Fraud Crime and how it can be prevented

0 kommentar(er)

0 kommentar(er)